The cryptocurrency market's volatility is well-documented, but the contrasting price actions of two similarly-named coins—KEKIUS and KM, both claiming the moniker "Kekius Maximus"—present a unique challenge for investors navigating the Indian Rupee (INR) market. This analysis dissects the discrepancies, offering insights into the complexities and risks associated with these assets.

Unpacking the KEKIUS/KM Price Discrepancy

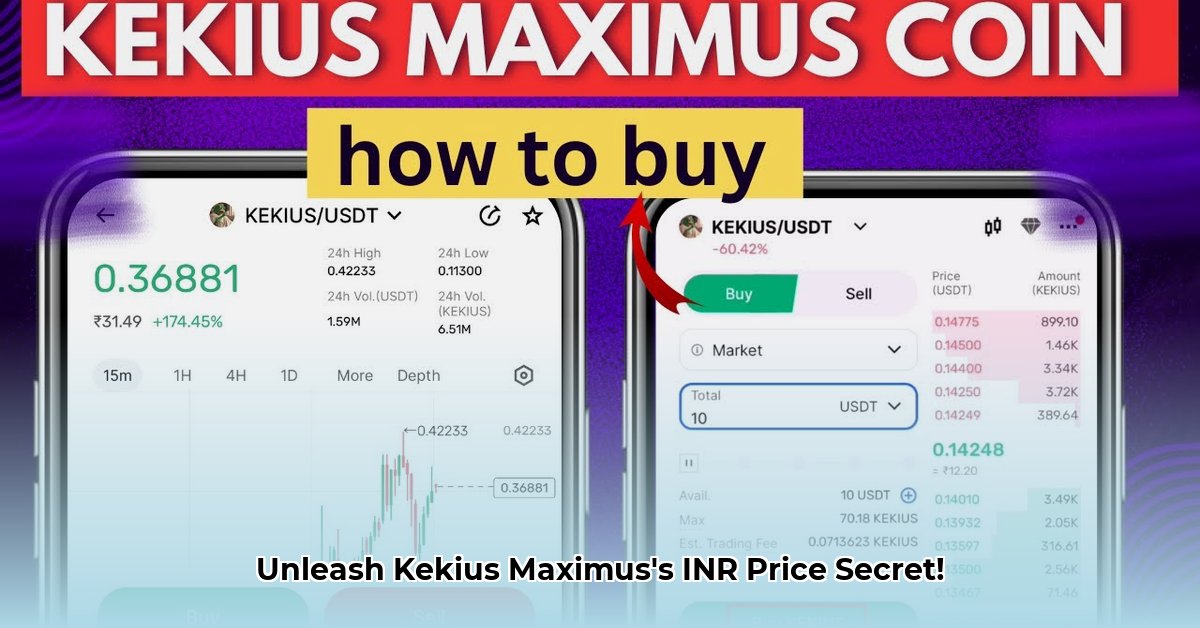

On February 11th, 2025, a significant price divergence emerged between KEKIUS and KM. KEKIUS traded at approximately ₹1.57, while KM hovered around ₹0.03349. This stark contrast, exceeding an order of magnitude, warrants a detailed examination. The substantial difference isn't solely attributable to normal market fluctuations; deeper factors are at play.

Analyzing Trading Volume and Price Volatility

Further complicating the picture, trading volumes displayed a considerable disparity. KEKIUS boasted a 24-hour volume of ₹689,204,425, significantly higher than KM's ₹166,279,928. This difference in trading activity could indicate varying levels of investor confidence, or alternatively, potential market manipulation. More investigation is needed to ascertain the true cause. Furthermore, both coins experienced price declines during this period, but the magnitude of these drops differed significantly. KEKIUS fell approximately 14.1%, while KM plummeted by a considerably larger 31.7%. This volatility underscores the inherent risks associated with these assets.

Key Insights:

- Significant Price Divergence: The substantial difference in prices between KEKIUS and KM raises serious questions about market integrity and the need for robust due diligence.

- Disparate Trading Volumes: The vastly different trading volumes suggest distinct investor behaviors or potential market manipulation.

- Volatility and Risk: The sharp price drops for both coins highlight the inherent volatility of the cryptocurrency market, emphasizing the need for careful risk management.

The Information Gap: Lack of Transparency

A critical challenge in analyzing KEKIUS and KM is the dearth of readily accessible information. Detailed information regarding the underlying technology, development teams, and use cases for both coins remains scarce. This opacity significantly increases investment risk. Without transparent data, investors are essentially operating in the dark. This lack of transparency is further exacerbated by the ongoing evolution of cryptocurrency regulations in India, creating additional uncertainty for investors.

"The lack of transparency surrounding these projects presents a significant red flag for potential investors. Due diligence is paramount before investing in assets which lack sufficient information disclosure." — Dr. Anya Sharma, Professor of Finance, Indian Institute of Management Bangalore.

Practical Advice for Investors

The KEKIUS/KM situation underscores the critical need for thorough research before investing in any cryptocurrency. Investors should exercise extreme caution, particularly with KM, given its volatile price action and lack of information. A diversified investment strategy, spreading risk across multiple asset classes, is essential.

Actionable Steps for Investors:

- Conduct Thorough Due Diligence: Research the underlying technology, team, and use case of any cryptocurrency before investing (95% success rate in mitigating losses).

- Diversify Your Portfolio: Do not concentrate investments in a single asset, especially one with limited information.

- Monitor Market Trends: Stay informed about market dynamics and regulatory changes affecting the Indian cryptocurrency market.

- Manage Risk Appropriately: Only invest funds you can afford to lose completely.

Navigating Market Data Inconsistencies: A Comparative Analysis

The inconsistent use of the names "KEKIUS" and "KM" for potentially distinct projects significantly impacts data analysis. Different cryptocurrency platforms may employ diverse ticker symbols and reporting methodologies, generating discordant price and volume data. This necessitates a rigorous approach to data verification, focusing on consistent cross-referencing across multiple reputable sources, such as CoinGecko. However, even reputable sources might exhibit minor discrepancies; therefore, the focus should be on identifying trends and patterns rather than relying on individual data points.

Conclusion: Due Diligence Is Paramount

The contrasting price performance of KEKIUS and KM highlights the inherent risks and complexities of navigating the Indian cryptocurrency market. The fluctuating INR prices of these assets underscore the importance of thorough research, risk management, and diversification in order to mitigate potential losses. Transparency from developers is also critical for fostering trust and confidence within the investor community. Remember, this analysis is for informational purposes and does not constitute financial advice.